Higher rates are actually protecting real buyers from what’s worse…competition.

Everyone says, it’s all about the rates…sort of; but perhaps not in the way you’re thinking about it. My Father will tell me this is too long, but I think the concepts are important to communicate.

Purchasing Power

What will happen if (WHEN) interest rates drop a point.

Currently the 30 Year Fixed Mortgage is at 7.22%

$1M borrowed at 7.22% = $6,801/month or $81,612/year

Imagine when interest rates drop to say 6.0%

$1M borrowed at 6.0% = $5,996/month or $71,952/year

That is a difference of $805/month or $9,660/year

And eventually interest rates are anticipated to drop even further,

into the 5% range within the next 12-24 months

Alternatively, we could look at it this way:

At 7.22%, $6,801/month will afford you a $1,000,000 mortgage.

At 6.0%, the same $6,801/month would afford you a $1,134,500 mortgage.

Naturally, the above analysis makes someone think they should wait to buy, when financing is cheaper. The problem is when competition is elevated, you may never even have the opportunity to secure a property to work with. It’s like not having a restaurant reservation at a good place; if you can’t even get in, how can you eat?

How you digest and interpret the above…and strategically weigh

all the combating forces that influence our marketplace,

particularly the competition of the moment, will dictate your success.

So right now, the higher rates are actually protecting real buyers

from the masses…and that includes sellers. Here’s how:

Remember when I asked: “Are you thinking of buying next year?…so is everyone else!” Well, it’s all perception. In the big picture of what is required to purchase a property in Manhattan, rates are an extremely important metric, but…like price…is not the most important. The most important component to the buying process is the competition* and it’s THE biggest barrier to entry into Manhattan.

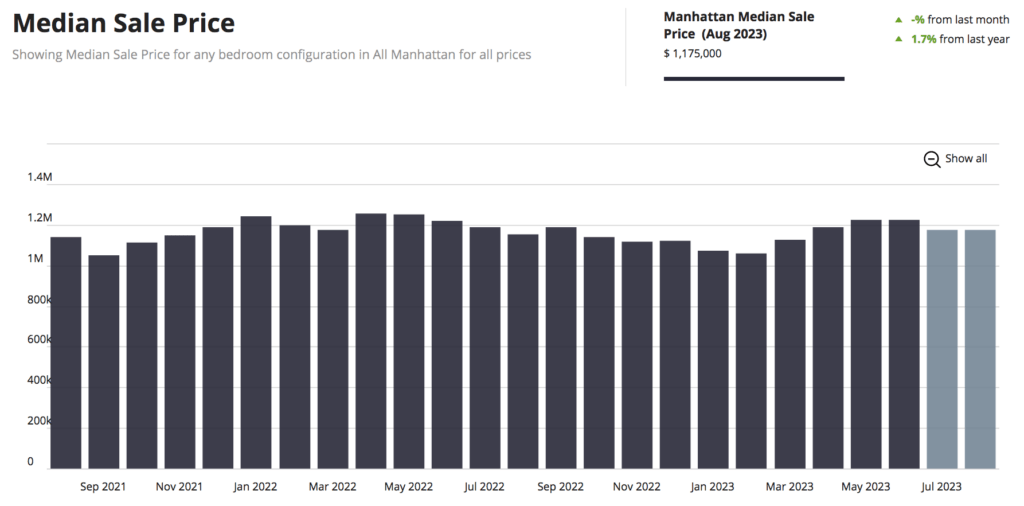

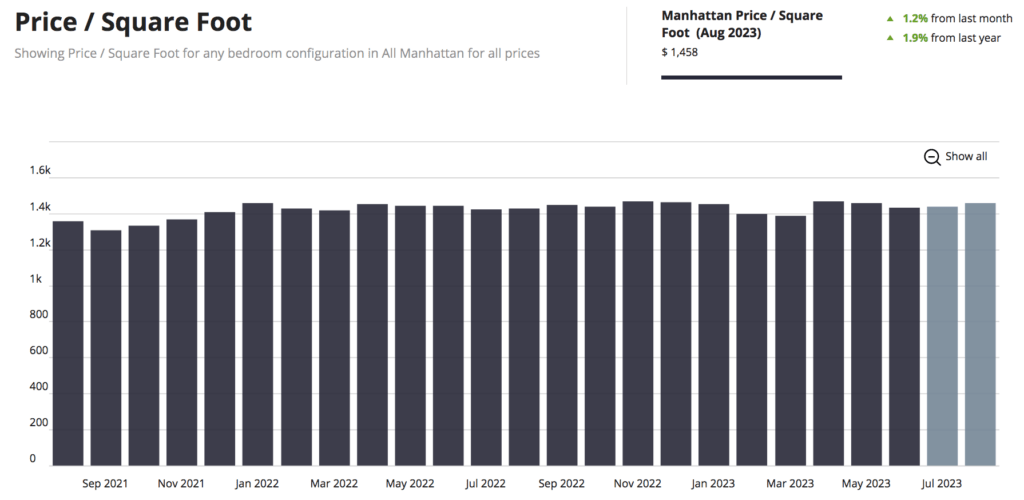

Where are we? Rates are higher (much higher) than they were. So from a relative perspective the increase is painful. For years, we had been in a very artificially low interest rate environment, which we sadly believed was normal. Moving forward, it’s hard to predict where rates will settle in 12-24 months. One thing we all agree on is, rates have over doubled in the past 15 months (from 3% to 7%+). As a result, the dance floor of both buyers and sellers as been cleared, leaving only those truly committed to the task. You would think this weakness would soften prices…but no, inventory has been tight. See the following two charts which make those buyers, who’ve been dreaming of tumbling prices, cry.

Click on each respective chart to expand. Courtesy: UrbanDigs

Both the median price and the $/sqft of units in Manhattan have been flat over the past year, if not gone up slightly. With this level of price stability, at a time when rates have spiked like no other occasion in our lifetime, one can only conclude that any decrease in rates will generate a substantial increase in demand (competition*) and put upward pressure on prices. Consequently, any notions and/or hopes for a major downward price correction are faint. Meaning the correction has likely already occurred.

Buyers feel their purchasing power will be stronger when interest rates come down. True, except that demand will likely out-leverage purchasing power. So what happens when those rates actually do drop? The velocity of buyers entering the marketplace will immediately accelerate. In all of the market cycles I have experienced in my 25 years of selling Manhattan real estate, this type of shift happens ever so quickly, too often leaving most buyers looking at each other saying, “what just happened; the market was just dead.” This is the oh-so-typical Manhattan story, when pent-up demand from both buyers and sellers could be prohibitive.

So your buying strategy options are:

A) wait for falling prices = unlikely to happen.

B) wait for rates to fall = this may not occur until Spring, if not summer. And again, everybody is thinking the same thing, “I will buy next year when rates come down”, meaning palpable competition*. Hurd mentality and FOMO will ensue. Just think, you could have actually secured a property by then, begun to build equity and then simply refinance when rates eventually moderate. If you wait, prices will most certainly be higher as a result.

C) just get to the business at hand and jump in. Whatever saying you prefer: the early bird always gets the worm or early adopters always win…you get the point.

Interestingly, most Sellers have not wanted to engage in this high interest rate environment either; primarily because, they’ve not wanted to give up their own low mortgages. This has aggravated an already tight supply dynamic. September’s typically robust inventory flow could serve to ease some of that pressure. There’s also hopes that the “life happens” principle begins to leak in, meaning that people simply have to move…divorce, children, new jobs etc.; this should also free up more property.

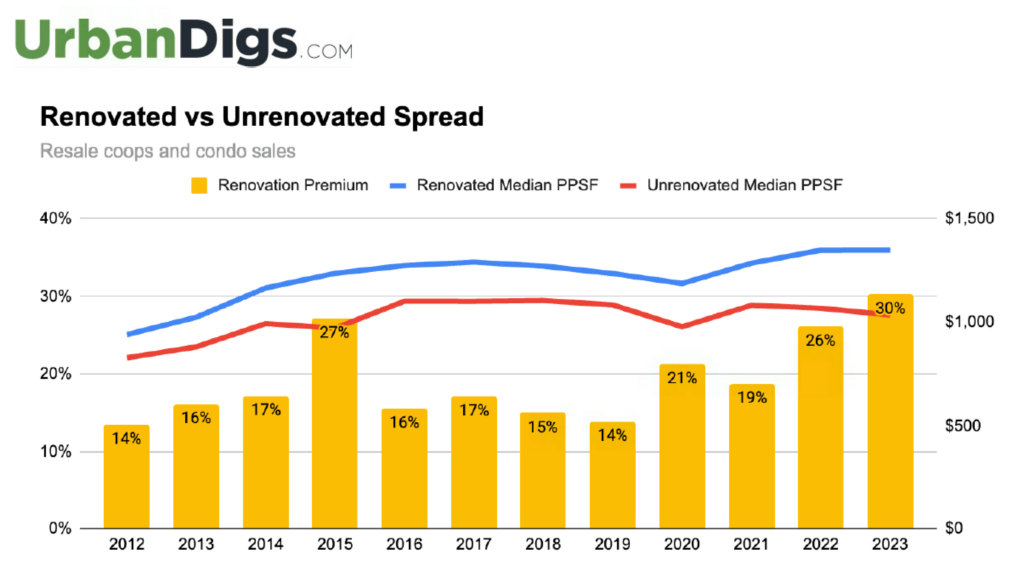

The best deals are still those that require renovation.

See chart below, renovated apartments are trading at a 30% premium.

Click chart to expand. Courtesy: UrbanDigs

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.